Selecting the Right CMS for Fintech: 2025 Security & Compliance Guide

The best CMS for fintech companies prioritizes security-first architecture, regulatory compliance, and seamless integrations with financial systems. Unlike generic content platforms, fintech organizations need specialized solutions that handle sensitive financial data while maintaining the agility to compete in rapidly evolving markets.

Choosing the wrong content management system isn't just a technology mistake—it's a business risk that can expose your company to security breaches, compliance violations, and operational bottlenecks that slow your time to market. With financial services facing increasingly sophisticated cyber threats and stricter regulatory oversight, your CMS decision directly impacts customer trust, regulatory standing, and competitive positioning.

This comprehensive guide cuts through the marketing noise to provide CTOs, CMOs, and product managers with a practical framework for evaluating CMS options that actually work in the high-stakes fintech environment.

What to Look for in a Fintech CMS

1. Security-First Architecture

Your CMS must treat security as a foundational requirement, not an add-on feature. Look for platforms with role-based access controls, comprehensive audit trails, and built-in encryption that meets banking-grade standards.

2. Regulatory Compliance Capabilities

The platform should support compliance frameworks like PCI DSS, GDPR, and SOC 2 Type II out of the box. This includes data residency controls, automated compliance reporting, and audit-ready documentation.

3. Enterprise-Grade Performance

Financial services can't afford downtime or slow page loads. Your CMS needs guaranteed uptime SLAs, global CDN capabilities, and architecture that scales with your business growth.

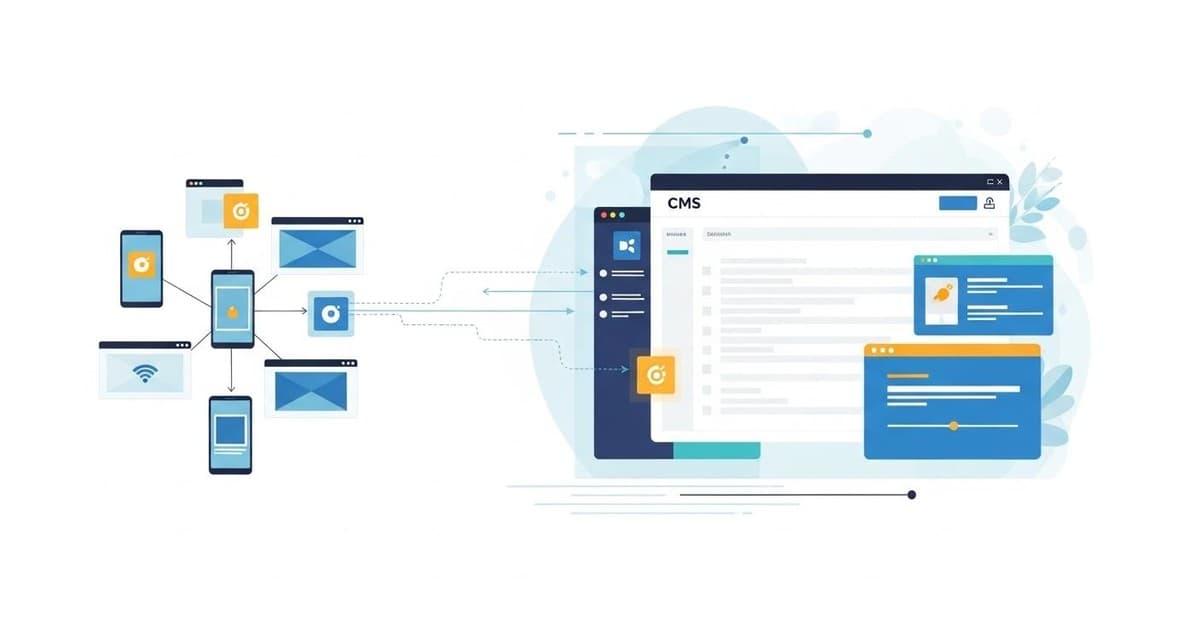

4. Seamless Integration Ecosystem

Modern fintech operates through connected systems. Your CMS must integrate smoothly with core banking platforms, CRM systems, marketing automation tools, and analytics platforms through robust APIs.

5. Team Collaboration Without Compromise

Marketing teams need intuitive content creation tools while developers require flexible deployment options. The best fintech CMS solutions balance user-friendly interfaces with technical sophistication.

The 5 CMS Approaches That Work for Financial Services

After evaluating dozens of platforms against fintech-specific requirements, these five approaches consistently deliver the security, compliance, and performance that financial services demand. Each offers distinct advantages depending on your team structure, technical resources, and growth trajectory.

1. AI-Native CMS Platforms (Decipher CMS)

AI-native content management systems represent the next evolution in fintech content operations, embedding intelligence directly into workflows rather than retrofitting manual processes with automation features. These platforms eliminate the bottlenecks that traditionally slow content operations in regulated industries.

Decipher CMS exemplifies this approach with self-hosted cloud deployment that gives fintech companies complete data sovereignty while delivering 45% increases in content publishing velocity. Unlike traditional platforms that charge per-seat pricing, the system scales with unlimited team members—crucial for growing fintech organizations that can't predict headcount growth.

Key Advantages: Built-in compliance workflows, predictive content optimization, automated quality checks, and seamless team collaboration without version control chaos. The AI learns from your team's patterns to continuously optimize processes while maintaining security standards.

Considerations: As a newer category, AI-native platforms require evaluation of vendor stability and long-term roadmap alignment with your business needs.

2. Enterprise Headless CMS Solutions

Headless architecture separates content management from presentation, offering fintech companies the flexibility to deliver content across multiple channels while maintaining centralized control. Leading headless platforms provide the API-first approach that modern financial services require.

This architecture excels in omnichannel scenarios where content needs to appear consistently across web platforms, mobile apps, and third-party integrations. The separation of concerns allows security teams to focus on protecting the content layer while developers optimize frontend performance.

Key Advantages: Superior security through API-based architecture, unlimited frontend flexibility, excellent performance at scale, and strong developer experience for custom integrations.

Considerations: Requires significant development resources and may create complexity for marketing teams who need direct content editing capabilities.

3. Traditional CMS with Enterprise Security

Established platforms like WordPress and Drupal can work for fintech when properly configured with enterprise-grade security modules and hosting environments. However, replacing WordPress often becomes necessary as companies scale beyond basic content needs.

These platforms offer extensive plugin ecosystems and familiar interfaces that reduce training requirements for marketing teams. When combined with managed hosting providers that specialize in financial services, they can meet basic compliance requirements.

Key Advantages: Large developer community, extensive customization options, familiar user interfaces, and lower initial implementation costs.

Considerations: Inherent security vulnerabilities in plugin architecture, ongoing maintenance overhead, and scaling challenges as content volume grows.

4. Hybrid (Decoupled) CMS Platforms

Hybrid solutions attempt to balance the user-friendly backend of traditional CMS with the flexibility of headless architecture. This approach can work for fintech companies that need both marketing team autonomy and developer flexibility.

The decoupled approach allows content creators to work in familiar editing environments while developers maintain control over how content appears across different channels and integrations.

Key Advantages: Balanced approach between usability and flexibility, reduced complexity compared to pure headless, and maintained content editing workflows.

Considerations: May not fully address either the security concerns of traditional CMS or the performance benefits of headless architecture.

5. Custom-Built Solutions

Some fintech companies choose to build proprietary content management systems tailored to their specific requirements and integrations. This approach offers complete control but requires substantial ongoing investment.

Custom solutions make sense for companies with unique compliance requirements or complex integrations that existing platforms cannot accommodate effectively.

Key Advantages: Complete customization, no vendor dependencies, perfect alignment with business processes, and unlimited scalability potential.

Considerations: Significant development and maintenance costs, longer time to market, and the need for dedicated technical teams to support the platform long-term.

Making the Strategic Decision for Your Fintech

The most common mistake in CMS selection is prioritizing marketing features over security and compliance requirements. Financial services organizations that start with security as a foundation avoid costly migrations and compliance issues later.

Successful fintech CMS implementations follow a structured evaluation process:

- Assemble cross-functional teams including IT security, compliance, marketing, and development stakeholders from the beginning

- Define non-negotiable requirements around data residency, audit capabilities, and integration needs before evaluating features

- Calculate total cost of ownership including implementation, training, ongoing maintenance, and scaling costs over 3-5 years

- Test real-world scenarios through proof-of-concept implementations that mirror your actual content workflows and compliance requirements

The right CMS becomes a competitive advantage that accelerates your content operations while maintaining the security and compliance standards that build customer trust. Modern platforms eliminate the collaboration bottlenecks that slow traditional financial services marketing, enabling the agility that today's market demands.

Your CMS decision shapes how effectively your team can respond to market opportunities, regulatory changes, and customer needs. Choose a platform that grows with your business rather than one that requires replacement as you scale.